As administrators we often have distressed

assets for sale, you will find them here.

FILTER ASSETS FOR SALE

22-34 Young Street, West Gosford

Property

Wexted Advisors as Receivers and Managers offer the opportunity to acquire 22-34 Young Street, West Gosford. The development site comprises seven separate commercial sites with a total estimated area of ~8,162 square meters and a frontage to Young Street of 140 metres.

Read MorePacific Metal Group business and assets - Pakenham and Laverton, Victoria

Business

Property

Voluntary Administrators of Scrap Holdco Pty Ltd and its subsidiaries, trading as Pacific Metal Group, seek expressions of interest for one of the largest collectors, processors and suppliers of recycled metal in Victoria.

Read More20-30 Crozier Street, Port Adelaide, SA

Property

Wexted Advisors as Receivers and Managers offer the opportunity to acquire 20 -30 Crozier Street , Port Adelaide, SA comprising ~15,480 sqm with multiple tenants.

Read MoreStrategic Fuel Investment with 15 year lease- 9 Norton Promenade, Dalyellup WA

Property

Business

Wexted Advisors as Receivers and Managers offer a strategic fuel investment with a new 15-year lease to 2036 plus options to 2051.

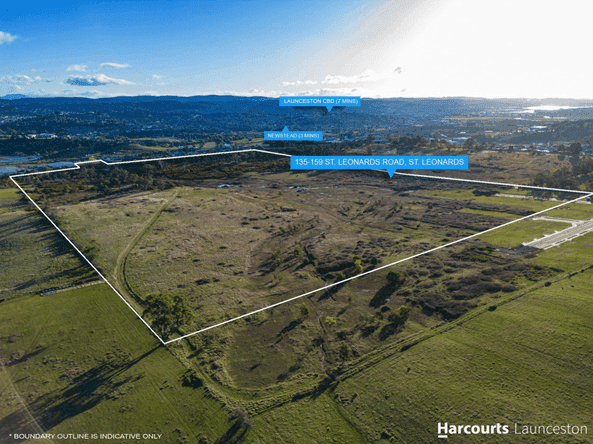

Read MoreCedar Grove Estate - St Leonards, Tasmania

Property

Wexted Advisors as Receivers and Managers offer the Cedar Grove Estate, a 40.34 hectare development site with DA Planning Permit for stages 2 and 3, located at 135 to 159 St Leonards Road, St Leonards, Tasmania.

Read MorePARK FAST (S.A.) CAR PARKING BUSINESS FOR SALE- EXPRESSIONS OF INTEREST

Business

FRANCHISE

Wexted Advisors as Receivers and Managers of Park Fast (S.A.) Pty Ltd (Receivers and Managers Appointed) are seeking urgent Expressions of Interest (EOIs) in a business/asset sale of a car parking business.

Read MoreMY BABY HQ - Brisbane- EXPRESSIONS OF INTEREST

Business

Wexted Advisors as Voluntary Administrators of My Baby HQ Pty. Ltd. (Administrators Appointed) are seeking urgent Expressions of Interest (EOIs) in a business/asset sale or recapitalisation via a Deed of Company Arrangement (DOCA) of an online and shop front retailer focusing in baby goods.

Read MoreMUGGA LANE SOLAR FARM - CANBERRA- EXPRESSIONS OF INTEREST

Business

Property

The Receivers and Managers of Mugga Lane Solar Park Pty Ltd and certain of its related entities (Administrators and Receivers and Managers Appointed to All) (MLSP Group), are seeking Expressions of Interest (EOIs) for the assets and business of the MLSP Group.

Read MoreYABONZA RENT ROLL - NATIONAL- EXPRESSIONS OF INTEREST

Business

Wexted Advisors as Liquidators of Yabonza Australia Pty Ltd is seeking urgent Expressions of Interest (EOI) for the sale of the rent roll asset.

Read MoreAGENT FOR MORTGAGEE IN POSSESSION- 20-30 IAN STREET NOBLE PARK - MELBOURNE

Business

Property

Wexted Advisors as agent for mortgagee in possession are pleased to offer 20-30 Ian Street, Noble Park, Victoria.

Read MoreAGENTS FOR MORTGAGEE IN POSSESSION- UNIT 806 250 PITT STREET SYDNEY NSW 2000

Business

Property

Wexted Advisors as Agents for Mortgagee in Possession are pleased to offer 806 / 250 Pitt Street Sydney NSW 2000 for sale.

Read MoreSOUGHT FINANCIAL PLANNING AND ACCOUNTING / TAXATION ASSETS- EXPRESSIONS OF INTEREST

Business

Wexted Advisors as Receivers and Managers of a Financial Planning and Accounting / Taxation services business, are seeking urgent Expressions of Interest (EOI).

Read MoreCROWN HOTEL- EXPRESSIONS OF INTEREST

Business

Property

Wexted Advisors are pleased to offer the Crown Hotel 587 – 589 Crown Street Surry Hills NSW 2010.

Read MoreNORTH NOWRA TAVERN- EXPRESSIONS OF INTEREST

Business

Property

Wexted Advisors are pleased to offer the North Nowra Tavern, 82 Page Avenue North Nowra NSW 2541.

Read MoreROSE & CROWN HOTEL FOR SALE- EXPRESSIONS OF INTEREST

Business

Property

Wexted Advisors are pleased to offer the Rose & Crown Hotel, 11 Victoria Road, Parramatta NSW.

Read MoreCORRIMAL HOTEL FOR SALE- EXPRESSIONS OF INTEREST

Business

Property

Wexted Advisors are pleased to offer Corrimal Hotel, 268 Princes Highway, Corrimal NSW.

Read MoreHEALTH PRECINCT, PORT MACQUARIE

Property

Wexted Advisors were appointed Receivers and Managers of Highfields, Port Macquarie – a health and aged care precinct across circa 20,785 sqm in Port Macquarie offered for sale by auction.

Read MoreDESIGNER AND MANUFACTURER OF ALUMINIUM WINDOWS AND DOORS

Business

Wexted Advisors as Voluntary Administrators of Mac Windows Pty Ltd (Administrators Appointed) restructured the business. Mac Windows is an established leading specialist in the design and manufacture of aluminium windows and doors.

Read MoreLEADING SPECIALIST POST TENSIONED CONCRETE CONTRACTOR- APS GROUP - NSW & VIC

Business

Wexted Advisors as Voluntary Administrators of APS Group restructured the business. Incorporated in 1982, APS Group is a leading specialists in Post Tensioned Concrete Contractors in Australia, with 200 strong workforce and operating across 60 sites in NSW and Victoria.

Read More